Book your spot at our upcoming Not-for-Profits Conference – February 26th

-

About us

BG Private is an AFR Top 100 accounting, audit, and advisory firm.

-

Our history

We have a proud 45-year history. Learn more about our journey here.

-

Our purpose statement

Discover our client service ethos, and the philosophy that drives us.

-

Need a guest speaker?

Our experts can present on a range of topics. Find out more here.

Services for businesses

-

Accounting & Business Advisory

Discover how our accounting and advisory services can help your business grow and reach its goals.

-

Audit & Assurance

Find out how we can assist you with your audit, assurance, and statutory reporting requirements.

-

Tax Advisory

Learn how we can answer your complex tax questions with our specialist insights and advice.

-

Corporate Advisory

Find out how our strategic and operational involvement can help your business maximise its value.

-

Private Equity

Learn how we generate healthy returns for investors by backing ambitious SME founders.

-

Property Advisory

Discover how we can help maximise your property portfolio with insights, strategy, and transaction support.

-

Bookkeeping

See how our bookkeeping services can help your business run smoothly so you can focus on growth and profitability.

-

Management Accounting

Discover how our Management Accounting service empowers business owners to make smarter, data driven decisions.

-

CFO Advisory

Discover how our CFO Advisory service can guide your decision-making and create lasting value for your company.

Services for individuals

-

Accounting Services

Discover all the ways we can help you navigate and optimise your tax matters.

-

Tax Advisory

Learn how we can answer your complex tax questions with our specialist insights and advice.

-

SMSF Management

Discover how we can help with the administration of your Self-Managed Super Fund.

-

Financial Planning

Find out how we can help you reach your financial goals.

Industries

-

Music & entertainment

Find out how we take care of the numbers so you can get back to playing the numbers.

-

Professional services

Explore how we can take care of the books so that you can spend more time on your clients.

-

Manufacturing, wholesale & retail

We can make your life easier while you make things for us all.

-

Property, construction & trades

We can help you build your financial future while you help build Australia.

-

Tech, media & creatives

Learn how we can take care of the “boring but important” so you can focus on making magic.

-

Hospitality

Read up on all the services we have for you, so you can get back to serving your guests.

Business types

-

SMEs

Learn how we partner you along your journey to help you create a thriving business.

-

Not-for-profits

Learn how we can help with your accounting and audit needs so you can focus on helping others.

-

Family businesses

Discover how we can help you every step of the way as you build a legacy-leaving family business.

-

Australian businesses overseas

We can help you navigate the exciting process of expanding overseas.

-

Foreign companies in Australia

We can help you set up and run your operations Down Under.

-

Articles

Read the latest BG updates and interesting articles from our expert advisors.

-

Case studies

See examples of how we have helped clients to learn how we can help you as well.

-

Video & podcasts

Get the latest insights from our experts on a range of topical money matters.

-

Events

Discover our upcoming events including webinars, in-person events, and fundraisers.

-

Newsletters

Catch up on our recent client newsletters which cover important news and updates.

-

Why choose us

Find out how we can help grow your career, and learn about our rewards and benefits.

-

Current opportunities

We are always looking for talented people! Browse our vacancies and apply today!

-

Recruitment process

We like to make the recruitment process as seamless as possible. Learn more here.

-

Experienced professionals

Find out why BG Private is a great place for seasoned professionals.

-

Graduates

Apply what you’ve been learning to real-world cases – launch your career with us!

-

Interns

If you’re studying Accounting, kick-start your career with an internship at BG Private.

Analysis of the Australian private equity market

- 27 June 2024

- by BG Private

- 6-minute read

What is Private Equity?

Private equity is the ownership or interest in a private company that is not transacted in a public market. Private equity firms raise funds from institutional investors and high-net-worth individuals to purchase stakes in private businesses. Post investment, private equity firms work closely with management teams to improve operations, drive growth, and ultimately sell the companies and generate a return on investment.

For business founders and owners the benefits of private equity investment includes:

- The ability to raise capital without the onerous requirements and costs of an initial public market offering

- Access to capital without the prohibitively expensive interest associated with debt funding

- The ability to leverage the expertise and resources of private equity firms to fast-track business growth.

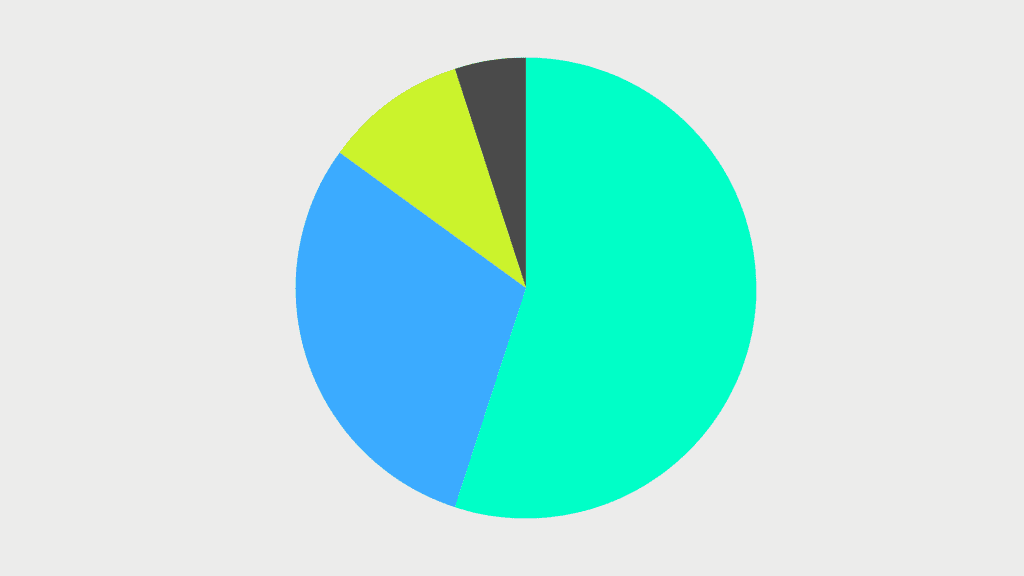

The Australian private equity market

Australia’s private equity market has grown substantially in the past decade, particularly with post pandemic-related disruptions fueled by historic low interest rates and government policy stimulus.

However, more recently private equity activity has declined substantially as borrowing costs have increased.

The value of assets under management by Australian and international private equity funds invested in Australian companies is $66 billion, which represents 2.6% of annual GDP.

The Australian private equity market is dominated by several major players, including firms like Pacific Equity Partners, Archer Capital, Carlyle Group, and Quadrant Private Equity. These firms have extensive portfolios and significant influence, often targeting large, well-established companies with substantial growth potential. These firms generally aim to acquire a majority and controlling stake in the investment companies, an approach which is not desirable for all owners and founders.

Government and commercial bank initiatives

Recognising the potential of the private equity market, the Australian Government and commercial banks have also become active participants.

This is evidenced by the establishment of the Australian Business Growth Fund (ABGF), which is a partnership between six major banks and the Federal Government aimed at providing growth capital to small and medium-sized enterprises (SMEs) that are poised for expansion but lack the necessary funding.

This initiative underscores the growing recognition of private equity’s role in fostering business growth and economic development.

Challenges for small companies

Despite the overall growth and opportunities in the Australian private equity market, smaller companies often face significant challenges attracting capital investment.

The approach of many large private equity firms is not desirable to many small- and medium-sized businesses. This is because these private equity firms are focused primarily on larger deals; want to take a controlling stake and control business strategy; want to replace management teams; and often have an overly aggressive appetite towards gearing levels.

BG’s role in Australia’s private equity landscape

BG’s private equity division (running under the Corner Capital brand) was established with a goal to address this gap in the private equity landscape.

We have a focus on small- and medium-sized business opportunities. We only make minority investments, allowing founders to substantially participate in the upside of a future business exit.

We support and assist founders in executing a shared growth vision and provide strategic advisory, growth capital, operational support, and transaction guidance.

Our approach revolves around creating long-term value for the founders we partner with. By focusing on SMEs, we can provide personalised attention to individual business positions, and tailor our strategies to meet specific needs.

We believe in building strong, collaborative relationships with our clients, ensuring that our interests are aligned and that we are fully invested in their success.

Contact us

Contact our Private Equity team to learn more on +61 3 9810 0700 or for more information.The Australian private equity market

Other articles you might like

The ATO is ramping up its issuing of director penalty notices

We are seeing a significant shift in the ATO’s debt recovery approach, in particular regarding director penalty notices (DPNs). Learn...

10 tax planning strategies for businesses in 2024

As we near EOFY, start thinking about strategies that can help your business reduce taxable income. Learn more.

2024/25 Federal Budget Takeaways

Discover some of the key takeaways from the 2024-25 Federal Budget, delivered by our Tax Advisory Partner Tim Olynyk.