New AML rules! Here’s what you need to know >> New article

-

About us

BG Private is an AFR Top 100 accounting, audit, and advisory firm.

-

Our history

We have a proud 45-year history. Learn more about our journey here.

-

Our purpose statement

Discover our client service ethos, and the philosophy that drives us.

-

Need a guest speaker?

Our experts can present on a range of topics. Find out more here.

Services for businesses

-

Accounting & Business Advisory

Discover how our accounting and advisory services can help your business grow and reach its goals.

-

Audit & Assurance

Find out how we can assist you with your audit, assurance, and statutory reporting requirements.

-

Tax Advisory

Learn how we can answer your complex tax questions with our specialist insights and advice.

-

Corporate Advisory

Find out how our strategic and operational involvement can help your business maximise its value.

-

Private Equity

Learn how we generate healthy returns for investors by backing ambitious SME founders.

-

Property Advisory

Discover how we can help maximise your property portfolio with insights, strategy, and transaction support.

-

Bookkeeping

See how our bookkeeping services can help your business run smoothly so you can focus on growth and profitability.

-

Management Accounting

Discover how our Management Accounting service empowers business owners to make smarter, data driven decisions.

-

CFO Advisory

Discover how our CFO Advisory service can guide your decision-making and create lasting value for your company.

Services for individuals

-

Accounting Services

Discover all the ways we can help you navigate and optimise your tax matters.

-

Tax Advisory

Learn how we can answer your complex tax questions with our specialist insights and advice.

-

SMSF Management

Discover how we can help with the administration of your Self-Managed Super Fund.

-

Financial Planning

Find out how we can help you reach your financial goals.

Industries

-

Music & entertainment

Find out how we take care of the numbers so you can get back to playing the numbers.

-

Professional services

Explore how we can take care of the books so that you can spend more time on your clients.

-

Manufacturing, wholesale & retail

We can make your life easier while you make things for us all.

-

Property, construction & trades

We can help you build your financial future while you help build Australia.

-

Tech, media & creatives

Learn how we can take care of the “boring but important” so you can focus on making magic.

-

Hospitality

Read up on all the services we have for you, so you can get back to serving your guests.

Business types

-

SMEs

Learn how we partner you along your journey to help you create a thriving business.

-

Not-for-profits

Learn how we can help with your accounting and audit needs so you can focus on helping others.

-

Family businesses

Discover how we can help you every step of the way as you build a legacy-leaving family business.

-

Australian businesses overseas

We can help you navigate the exciting process of expanding overseas.

-

Foreign companies in Australia

We can help you set up and run your operations Down Under.

-

Articles

Read the latest BG updates and interesting articles from our expert advisors.

-

Case studies

See examples of how we have helped clients to learn how we can help you as well.

-

Video & podcasts

Get the latest insights from our experts on a range of topical money matters.

-

Events

Discover our upcoming events including webinars, in-person events, and fundraisers.

-

Newsletters

Catch up on our recent client newsletters which cover important news and updates.

-

Why choose us

Find out how we can help grow your career, and learn about our rewards and benefits.

-

Current opportunities

We are always looking for talented people! Browse our vacancies and apply today!

-

Recruitment process

We like to make the recruitment process as seamless as possible. Learn more here.

-

Experienced professionals

Find out why BG Private is a great place for seasoned professionals.

-

Graduates

Apply what you’ve been learning to real-world cases – launch your career with us!

-

Interns

If you’re studying Accounting, kick-start your career with an internship at BG Private.

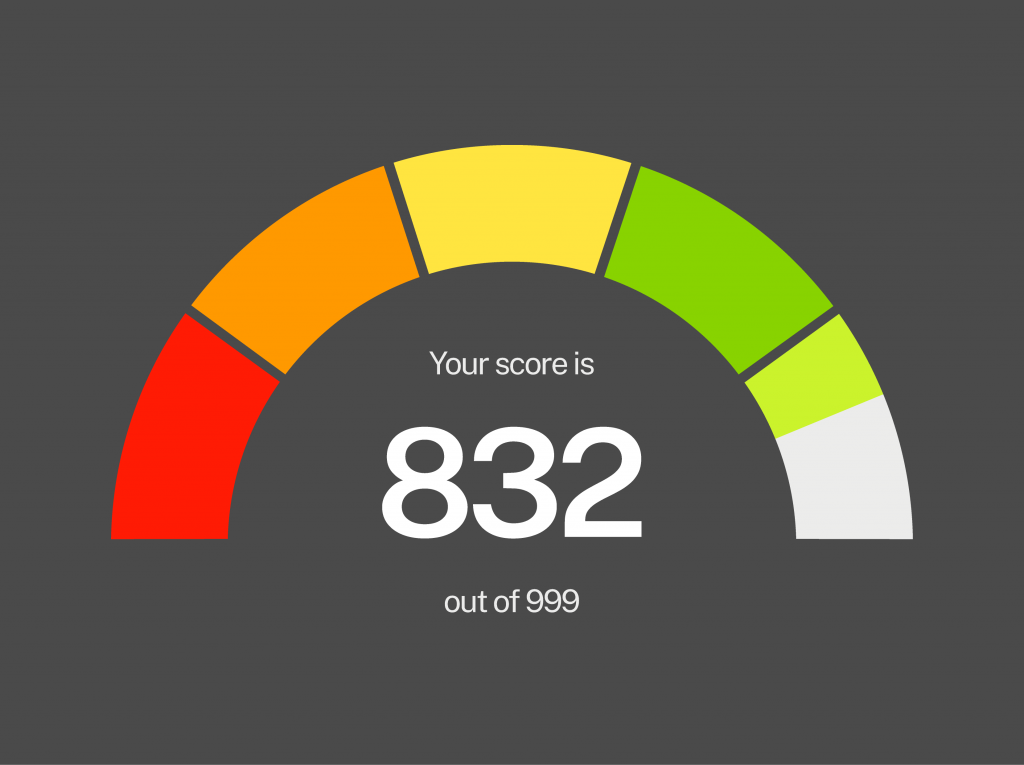

Thinking of taking out a home or investment loan? Don’t let your credit report slow you down

- 28 November 2025

- by guest contributor: Simon Wood | First Point Group

- 3-minute read

When you apply for a loan, Lenders don’t just look at income and savings – they also scrutinise your credit report and repayment / credit history. Even a minor blemish, like an overdue loan payment or late phone bill, can delay or derail a loan approval.

A quick credit check before you start the process can save a lot of stress later.

Why you should do a credit check today

Your credit report is your financial report card. It shows:

- Loan history, credit cards and phone/utility accounts and enquiries

- Whether you pay on time or late

- Any defaults, court judgements or bankruptcies

- How often you’ve applied for credit

Checking your report is a soft enquiry, so it won’t impact your credit score. It helps you:

- Spot errors or accounts that aren’t yours (it does happen!)

- Find late payments or small issues you may need to explain

- Clean things up before a Lender views it

The hidden trap: late payments

One of the most common problems we see is late payments on existing credit facilities – this can include home loans, credit cards or other facilities.

- A late payment will be recorded on your file and kept for up to two years – often these can be explained, and they don’t always derail the loan application

- A default (usually 60+ days overdue and over a set amount) can sit on your report for five years, even after it’s paid

Even a single default can:

- Limit how much you can borrow

- Push you towards more expensive lenders

- Cause delays while the bank asks for explanations

How to check your credit history

In Australia, the main credit reporting bodies are:

You’re entitled to free credit reports from each provider. In most cases you can request them online with basic ID and address history, then download your report as a PDF.

When you receive your report, check:

- Are all the loans/cards/accounts actually yours?

- Are there any late payments you don’t recognise?

- Are there any defaults you didn’t know about?

How to dispute an error

- Contact the credit provider in writing

Explain why it’s wrong and provide evidence. Ask them to correct the listing. - If that fails, you can escalate

You can complain to an Ombudsman or external dispute body (e.g. AFCA for banks, or the Telecommunications Industry Ombudsman for phone/internet). - Be cautious with “credit repair” agencies

Many charge high fees to do things you can often do yourself for free by dealing directly with the provider and credit reporting body.

Defaults are usually only removed if they’re wrong. If the listing is correct, it will generally stay for up to five years, even once paid.

If you’re not sure where to start, we can talk you through your options.

Avoiding hold ups in your finance application

Ideally, do a credit check 3–6 months before you plan to apply for a loan. That gives time to:

- Resolve any issues

- Close unused credit cards or facilities

- Dispute any errors

First Point Group can help you check your record – for free

Our experienced finance partners at First Point Group can help you obtain and review your credit report at no cost. They can:

- Order your report for you at no cost

- Explain how a lender is likely to view it

- Flag anything that might slow down a finance approval

If there’s a default – what next?

First step: don’t panic. Work out if the listing is:

- Accurate – you did fall behind, and the details look right

- Incorrect or unfair – wrong person, wrong amount, wrong dates, or the provider didn’t follow the proper process

We encourage you to get in touch with the team at First Point Group– Finance Brokers & Consultants for all of your finance needs. They have over 25 years of experience, a large panel of Lenders, and a team of experts who can guide you through the entire process of obtaining any type of loan/finance.

About the author

Simon Wood

Other articles you might like

Smarter ways to access business finance in 2025

At BG Private, we work closely with business owners who are navigating an increasingly challenging lending environment. Over recent months,...

Could Insurance Premium Finance help you?

Insurance premium finance can help smooth out insurance premium payments while meeting your payment obligations and keeping you covered

Investing in shares 101: Here’s how to get started

Discover everything you need to know about investing in shares including how much to invest, how to buy them, when...